Blog

Where to Purchase Hotel Furniture:

A Practical Guide for Developers, Hotel Owners, and Project Managers

Table of Contents

Introduction

Choosing where to purchase hotel furniture is rarely a simple buying decision. It affects budgets, timelines, operations, and long-term asset performance. The right sourcing strategy looks very different depending on whether you’re a real estate developer, a hotel owner, or a project manager.

This guide breaks down how each role evaluates hotel furniture suppliers, what really matters at each stage, and how one sourcing strategy can serve all three—without creating hidden risks later.

Section 1: For Real Estate Developers

What Developers Actually Care About When Purchasing Hotel Furniture

Developers evaluate hotel furniture decisions through a long-term lens. The concern isn’t one opening date—it’s how furniture choices perform across portfolios, phases, and future projects.

Total project cost matters more than marginal savings on a single hotel. A furniture decision that looks efficient today but causes redesigns, replacements, or coordination problems later quickly becomes expensive.

Standardization is another priority. When a wardrobe system, vanity layout, or headboard detail works well, developers want the ability to reuse it across projects with minimal redesign, re-approval, or risk exposure.

Supplier reliability over time is just as critical. Large developments rarely move in a straight line. Phases overlap. Timelines shift. Locations differ. The supplier must deliver consistent results months—or even years—apart.

Underlying all of this is durability. For developers, furniture is not decoration. It is part of the asset. Early failure affects valuation, not just maintenance costs.

Where Developers Usually Purchase Hotel Furniture

Experienced developers typically avoid retail channels early in the process. Instead, they purchase hotel furniture factory-direct, where pricing scales properly and production capacity matches volume requirements.

Many developers retain long-term FF&E partners across multiple projects. This is not about convenience—it’s about reducing friction. Fewer explanations. Fewer errors. Faster approvals.

Strong suppliers maintain detailed records: drawings, specifications, finishes, and approved details that allow future projects to move forward without restarting the process. That continuity delivers real cost and time savings.

Developer-focused suppliers also understand phased development schedules. They plan manufacturing and logistics around project sequencing, not just final handover dates.

Developer-Specific Pitfalls to Avoid

A common mistake is choosing boutique or retail-style suppliers who perform well on small projects but struggle to scale. What works for 80 rooms often breaks down at 300.

Another issue is re-approving furniture specifications on every project. This wastes time, introduces inconsistency, and adds risk without improving outcomes.

Developers also sometimes underestimate lifecycle cost. Lower upfront CAPEX can feel like a win—until replacements, downtime, and coordination costs erode returns.

Finally, fragmented sourcing creates hidden risk. More vendors mean more interfaces, more misalignment, and more opportunities for failure.

Developer Takeaway

The best place to purchase hotel furniture is a manufacturer who operates as a development partner, not a one-off supplier.

If they can scale with you, retain your standards, and protect asset value over time, the sourcing strategy is working.

Section 2: For Hotel Owners & Operators

Hotel owners and operators live with furniture long after opening day. Once the hotel is operating, furniture stops being décor and becomes a working asset—used, cleaned, moved, and stressed every day.

That’s why decisions about where to purchase hotel furniture focus less on price tags and more on real-world performance.

What Hotel Owners Should Prioritize When Buying Furniture

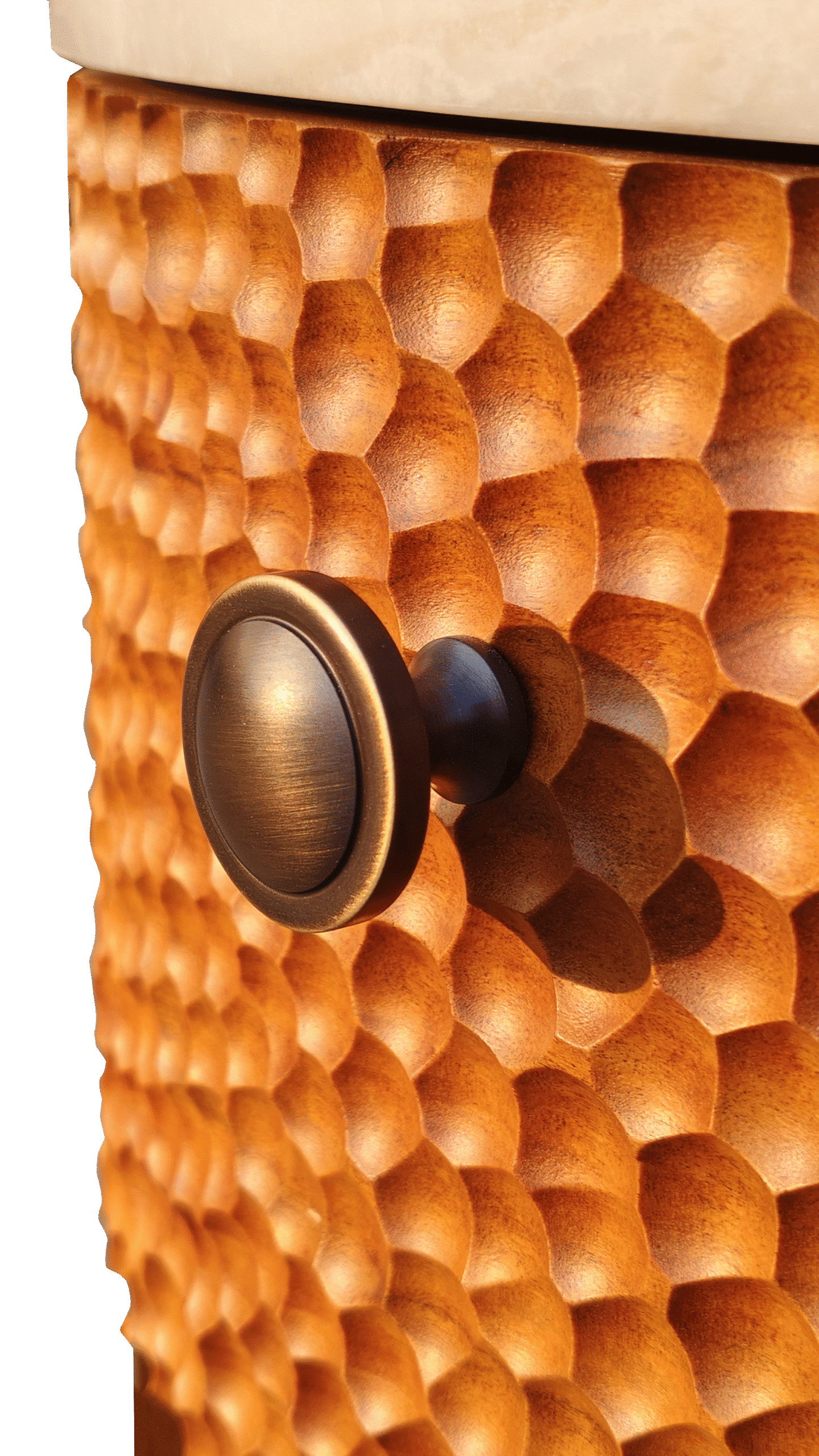

Durability is the first priority. Hotel furniture must withstand constant guest use, aggressive housekeeping routines, and commercial cleaning products without loosening, chipping, or degrading prematurely. If it can’t survive daily hotel conditions, it isn’t hotel furniture—regardless of appearance.

Brand and operational standards matter just as much. Whether operating under a global brand or independently, furniture must comply with fire ratings, material specifications, ergonomics, and layout rules. Deviations often surface later as failed inspections or forced replacements.

Maintenance is a quiet but decisive factor. Furniture designed for easy repair, refinishing, or partial replacement reduces downtime and long-term operating costs. Details like replaceable upholstery or accessible vanity panels make a measurable difference over years of operation.

Comfort and consistency are non-negotiable. Guests may not notice individual design details, but they do notice inconsistency. Uniform comfort, finish, and quality across rooms protects reviews and brand reputation.

Finally, warranty clarity matters more than warranty length. Owners need to understand exactly what is covered, what is excluded, and who is responsible after delivery.

Where Hotel Owners Commonly Purchase Hotel Furniture

Experienced owners avoid residential furniture retailers, even premium ones. Furniture designed for homes is not built for continuous commercial use.

Most owners work with hospitality-focused suppliers or custom hotel furniture manufacturers who understand how furniture performs under real operating conditions—where damage occurs, how housekeeping works, and what fails first.

Mock-up rooms and prototype testing provide significant value. Seeing furniture installed and adjusted before mass production exposes issues early, when changes are manageable.

Strong suppliers can also demonstrate real hotel references—projects that have been operating successfully for years, not just showroom samples.

Common Owner Mistakes

One frequent mistake is buying furniture that looks hotel-grade but lacks structural strength. Thin panels, weak joints, and residential hardware fail quickly once rooms are occupied.

Another is overlooking housekeeping impact. Heavy furniture without glides, fragile finishes, or awkward layouts slow cleaning and increase damage rates.

Owners also underestimate replacement lead times. Waiting weeks or months for matching replacements after opening creates real operational disruption.

Finally, warranties are often assumed rather than reviewed. Exclusions related to wear, cleaning methods, or misuse frequently surprise owners later.

Owner Takeaway

The right place to purchase hotel furniture is where durability, service, and accountability are built into both product and process—not promised after problems appear.

Section 3: For Project Managers

Project managers operate between drawings and reality. The role is not just execution—it’s coordination, sequencing, and risk control. When furniture issues arise, they rarely stay contained. They delay handovers, block rooms, and create site pressure.

What Project Managers Need from a Furniture Supplier

Clear shop drawings and disciplined revision control are essential. Drawings must reflect design intent, manufacturing constraints, and installation realities—and remain fixed once approved.

Predictable timelines matter more than optimistic ones. Suppliers who understand batching, container loading, and port congestion provide schedules that can be programmed around. “Flexible delivery” usually shifts risk downstream.

Packaging is another critical factor. Furniture must be protected for long-distance transport, multiple handling points, and active construction environments—not just container presentation.

Equally important is accountability. Project managers need a single point of responsibility when issues arise, not a chain of parties deflecting blame.

And when problems occur—as they inevitably do—responses must be practical and immediate.

Where Project Managers Prefer to Source Hotel Furniture

Project managers favor suppliers with real site experience. These partners understand incomplete floors, limited access windows, and shifting installation sequences.

Experienced manufacturers also understand installation order—what must arrive first, what can wait, and what cannot be installed twice. This knowledge reduces rehandling, damage, and wasted labor.

Strong partners coordinate smoothly with designers, quantity surveyors, and site teams. They provide drawings, packing lists, installation notes, and confirmations without repeated follow-ups.

In short, they deliver documentation, not excuses.

Project Manager Red Flags

Common warning signs include:

Lead times that change with every conversation

No formal mock-up or sample approval process

Furniture delivered without installation guidance

Multiple vendors shifting responsibility on site

Each increases execution risk and site pressure.

Project Manager Takeaway

The best place to purchase hotel furniture is from a supplier who reduces coordination pressure, not adds to it.

If they make the program easier to manage, they are worth retaining.

Hotel Furniture Purchasing Priorities: Developer vs Owner vs Project Manager

| Priority Area | Real Estate Developer | Hotel Owner / Operator | Project Manager |

|---|---|---|---|

| Primary Goal | Long-term ROI and asset value | Guest satisfaction & operational stability | On-time, on-budget project delivery |

| Key Concern | Cost control across multiple projects | Durability under daily hotel use | Schedule certainty and coordination |

| Budget Focus | Lifecycle cost, scalability, standardization | Maintenance, replacement, and repairs | Cost overruns caused by delays or rework |

| Furniture Type Preference | Standardized custom furniture systems | Hotel-grade furniture tailored to operations | Furniture that installs smoothly on site |

| Customization Level | Controlled customization for repeat use | Functional customization for comfort & upkeep | Minimal changes after approvals |

| Supplier Selection Criteria | Factory scale, consistency, long-term partnership | Proven hotel experience and warranties | Responsiveness and documentation quality |

| Risk Sensitivity | Design drift, inconsistent specs, future CAPEX | Guest complaints, wear-and-tear failures | Late delivery, wrong specs, site clashes |

| Lead Time Tolerance | Planned long-term, predictable pipelines | Moderate, aligned with opening dates | Very low tolerance—deadlines are fixed |

| Quality Control Focus | Repeatability across properties | Real-world durability and finish performance | Mock-ups, samples, approval accuracy |

| After-Sales Expectations | Stable supply for future projects | Fast repair, replacement, accountability | Quick issue resolution during defects period |

| Biggest Red Flag | One-off suppliers that can’t scale | “Looks good” furniture that fails in use | Vague timelines and unclear responsibilities |

| Ideal Supplier Role | Development partner | Operational partner | Execution partner |

How One Furniture Strategy Can Serve All Three Roles

When hotel furniture is sourced correctly, all stakeholders benefit—despite differing priorities.

Developers gain cost control and repeatability through standardized systems and retained specifications.

Owners gain durability and brand consistency through furniture designed for real hotel use.

Project managers gain smoother execution through fewer vendors, clearer drawings, and predictable timelines.

This typically requires:

Factory-direct sourcing

Clear FF&E scope definition

Early mock-up approval

One accountable partner

A strong furniture strategy doesn’t optimize for one role alone.

It reduces friction across the entire project lifecycle.

Final Thought

If you’re asking where to purchase hotel furniture, the real question is this:

Who do you want solving problems when things go wrong?

Because something always does. A shipment slips. A finish varies. An installation takes longer than planned.

The right supplier doesn’t disappear at that point. They step in, resolve the issue, and keep the project moving.

That decision shows up later—on site, under pressure—when it matters most.

FAQs

Hotels typically purchase hotel furniture from hospitality-focused suppliers or factory-direct manufacturers rather than residential retailers. These suppliers offer hotel-grade durability, customization, and long-term support.

It depends on project size and priorities. Local suppliers offer shorter lead times and easier coordination, while overseas manufacturers often provide better pricing, customization, and scalability for large hotel projects.

Hotel furniture is designed for heavy daily use, commercial cleaning, and long service life. Residential furniture may look similar but often lacks the structural strength and materials required for hotel environments.

Yes, many developers purchase hotel furniture factory-direct to control costs, standardize designs across projects, and reduce long-term sourcing risks—especially for multi-property developments.

Hotel owners should prioritize durability, maintenance ease, brand compliance, comfort consistency, and clear warranty terms rather than focusing only on upfront price.

Project managers can reduce risk by working with suppliers who provide clear shop drawings, stable lead times, proper packaging, mock-up approvals, and one point of accountability.

Common mistakes include choosing non-hotel-grade furniture, ignoring lifecycle costs, underestimating lead times for replacements, and working with suppliers who lack real hotel project experience.

Production and delivery timelines vary by project scope and supplier, but hotel furniture typically requires several weeks for manufacturing plus additional time for shipping and site coordination.

Custom hotel furniture may cost more upfront, but it often reduces long-term costs through better durability, easier maintenance, and improved fit with hotel layouts and operations.

The best approach is to select a supplier who understands hotel operations, can scale with the project, provides transparent documentation, and remains accountable after delivery.